Decrypts the secret key

2. Decrypts the information,

message digest, and account holder's public key.

3. Computes and compares message

digest

· The certified

documentation is then encrypted using a secret key which is in

turn encrypted with the account holder's public key.

· The certified

documentation is then verified by the account holder by using

Merchant

registration:

· Merchant must

register with TPs that correspond to particular

account type that they wish to

honor before transacting business with customer

who share the same account types.

For example if a merchant wishes

to accept visa and MasterCard ,that

merchant may have to register

with two TPs or find a TP that represent both

· The merchant registration is similar to the account holder's registration

process.

Account

Holder(customer)ordering:

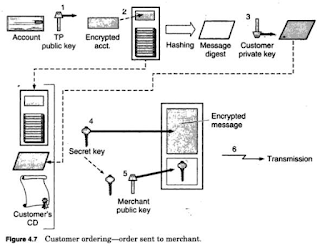

· To send a

message to a merchant the customer (account holder)must have a

copy of the merchant's public key

and a copy of the TPs public key that

corresponds to the account type

to be used.

· The order form is completed ,that customer software does the following

the public key of the TP, thus

checking the digital signature. The account

holder's software for future use in electronic commerce transaction.

Ø Encrypts account

information with the TP‟s public key.

Ø Attaches

encrypted account information to the order form

Ø Creates a

message digest of the order form and digitally signs it with the

customer's private key.

Ø Encrypts the

following with the secret key order form ,digital signature, and

customer's.

Ø Encrypts secret

key with the merchant's public key from the merchant CD.

Ø Transmits the

secret key encrypted message and encrypted secret key to the

merchant

· When the merchants software receives the order ,it does the following

Payment

authorization:

· The processing

of an order ,the merchant will need a authorize(clear) the

transaction with the TP

responsible for that particular account.

· The

authorization assures the merchant that the necessary funds or credit

limit is available to cover the

cost of the order.

· The merchant has

no access to the customer account information since it

was encrypted using the TP‟s

public key thus it is required that this

information be sent to the TP so

that the merchant can receive payment

authorization from the TP and

that the proper customer account is debited

for the transaction.

TP the following information

using encryption and digital signature process

previously described:

v Merchant's CD

v Specific order

information such as amount to be authorized order , number,

date.

v Customers ID

v Customers

account information

· After verifying

the merchant , customer, and account information the TP

would then analyze the amount to be authorized

On-Line

Electronic cash:

Overview:

· E-cash works in

the following way: a consumer opens an account with an

appropriate bank.

· The consumer

shows the bank some form of identification so that the bank

knows who the consumer is.

· The e-cash is

then stored on a PCs hard drive or possibly a PCMCIA card

for later use.

· These

transaction could all be done using public key cryptography and

digital signatures as discussed

easily.

Problem with

simple electronic cash:

· A problem with

the e-cash example just discussed is that double spending

cannot be attacked or prevent

since all cash would look the same.

· The bank sees

e-cash from a merchant with a certain serial number ,it can

trace back to the consumer who

spent it and possibly deduce purchasing

habits

· This frustrate

the nature of privacy associated with real cash.

Creating

electronic cash anonymity:

· To allow

anonymity the bank and the customer must collectively create the

e-cash and associate serial

number, whereby the bank can digitally sign and

thus verify the e-cash ,but not

recognize it as coming from a particular

consumer.

· To get e-cash

the consumer choose a random number to be used as the serial

number for the e-cash.

Preventing

double spending:

· While the

preceding process protects the anonymity of the consumer and

can identify when money has been

double spent ,it still does not prevent

consumer ,or merchant for that

matter ,from double spending.

· To create a process

to identify double spender but one that keep the

anonymity of lawful individuals

requires the use of tamperproof software

and complex cryptography

algorithms.

· The software

prevents double spending by encrypting an individuals

identity by using a random secret key generated for each piece of e-cash.

E-cash

Interoperability:

· Consumer must be

able to transact with any merchant or bank .Hence

process and security standard

must exit for all hardware and software used

in e-cash transaction.

· Interoperability

can only be achieved by adherence to algorithm and process

in support e- cash-initiate

commerce

Electronic

payment scheme:

The leading commercial electronic

payment schemes that have

been proposed in the past few

years and the companies using them .

Netscape. Netscape secure

courier electronic payment scheme which has been

selected by intuit for secure

payment between users of its quicken home

banking program and bank use

SEPP.

Microsoft: Microsoft STT is

similar to SEEP/SET in that it provides digital

signature and user authentication

for securing electronic payments. STT is

an embellished version of

Netscape's SSL security tool and is compatible

with SSL version 2.0.

Check free: check

free corporation provides online payment processing service

to major clients

To major clients, including

CompuServe, Genie, Cellular one, Delphi Internet

service corporation and Sky-Tel.

check free has also announced intension to

support all security methods that

achieve prominence inn the marketplace.

e.g., SET.

Cyber Cash :combines features from checks and is a

digital cash software system

which is used like a money order guaranteeing

payment to the merchant before

the goods shifting. Cyber Cash wants a

micropayment capabilities of 5 to 20 cents pre transaction.

VeriSign: VeriSign is

offering its digital signature technology for

authenticating as a component

separated from encryption which allows for

export of stronger

authentication. IBM is building support for digital ID into

its web browser and internet

connection secure server for AIX and OS/2.

Digi Cash: Digi Cash is a

software company whose products allow users to

purchase goods over the internet

without using accredit card. The threat of

privacy loss(where expenses can

be easily traced ) gave rice to the idea of

anonymous e-cash ,an electronic

store of cash replacement funds which can

be loaded into a smart card for

electronic purchase.

First virtual

holding:It‟s

targeting individuals and small business that want to

buy and sell on the internet but

cannot afford an extensive on-line

infrastructure. A first virtual

e-mail account and first virtual hosting system

to track and record the transfer

of information ,products , and payment for

accounting and billing purpose

,consumer and merchant can buy and sell

goods on the internet without

sensitive information such as credit card

number moving across the network.

All sensitive information is delivered

by telephone.

Commerce Net: In 1993 a group

of silicon valley entrepreneurs envisioned the

internet as a whole new model of

commerce one defined around global

access a large number of buyers

and seller many to many interaction and a

significantly accelerated pace of

procurement and development they called

this model Spontaneous commerce.

Net cash :Net cash is the

internet answer to traveler's check. To use Net cash user

must enter their checking account

or credit card numbers into an on screen

form and e-mail it to the

Net cash.

Other approach: This section

lists a few other approaches that have appeared

in the recent past.

Mondex is based on

smart card technology initially backed by the united

kingdom's West minster and

midland Banks. The electronic purse is a

handled smart card it remembers

previous transaction and use RSA

cryptography.

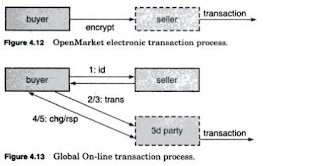

Open market handles credit

card transaction via web servers but it was planning

to provide support for debit cards

checking account and corporate purchase

order.

Global online use on-line

challenge/response. It is based on a third party

originating agreements therefore

the seller has a higher cost to enter the

market.

Wallet and such: Even in the

absence of standards(e.g., SET) vendors have

been developing system to handle

sales over the internet and companies

willing to accept that the

products are not interoperable can support business

before standard become widely deployed.

No comments:

Post a Comment