- As business activity grows on the to take into account and to address, to the stakeholders‟ satisfaction.

- Security relates to three general areas.

- Secure file/information transfer

- Secure transaction

- Secure enter price network, when used to support web commerce

- The security issue must be addressed quickly in order for companies to start investing in electronic commerce .

- There are indications that merchants are taking a wait-and –see attitude in electronic commerce on the internet until either there is a dominant standard or there is universal software that will support a variety of encryption and transaction schemes.

- The market is looking for a comprehensive solution (in a software product) that the merchants and banks can use to support all functions.

- Computer security has several fundamental goals

- Privacy: keep private document private, using encryption, passwords and access control system.

- Integrity: data and applications should be safe from modification with out the owner's consent

- Authentication: ensure that the people using the computer are the authorized users of that system.

- Availability: the end system (host) and data should be available when needed by the authorize user.

- The secure sockets layer system from Netscape communication and the secure hypertext transfer protocol from commerce net offer

- Secure means of transferring information through the internet and the world wide web.

- SSL and S-HTTP Allow the client and server to execute all encryption and decryption of web transaction automatically and transparently to the end user.

- S-HTTP (http://wwe.eit.com ) is a secure extension of HTTP developed by the commerce vet consortium.

- S-HTTP offers security techniques and encryption with RAS methods, along with Other payment protocols.

- For secure transport S-HTTP support end –to-end secure transition by incorporation cryptographic enhancements to be used for data transfer at the application level this is in contrast to existing HTTP authorization mechanisms.

- S-HTTP incorporated public-key cryptography from RSA data security in addition to supporting traditional shared secret password and Kerberos based security system.

- The RSA data security cipher used by S-HTTP utilized two Keys files encrypted by one can only be decrypted by application of the other key the recipient decrypts it with the private key.

- The secured sockets layer (SSL) protocol developed by Netscape communications is a security protocol that provides privacy over the internet.

- The protocol allows client /server application to communicate in a way that data transmissions cannot be altered or disclosed.

- Servers are always authenticated and client are Optionally authenticated

- The technology has support for key exchange algorithms and hardware tokens the strength of SSL is that it is application independent .

- HTTP, Telnet and FTP can be placed on top of SSL transparently SSL provide channel security (Privacy and authentication) through encryption and reliability through a message integrity check (secure has function).

- Netscape state that SSL aims at making the cost of such an attack greater that the benefits gained from a successful attack Thus making it a waste of time and money to perform such an attack.

- The good news is that the SSL and S-HTTP standard which will accommodate both protocols making the use of encrypted credit card transaction even easier to implement.

- A related capability is a certification authority to authenticated the public keys on which the RSA system relies .

- The goal is to assure users that public key that seems to be associated with a company actually is and is not a spurious key the authority requires applicants to prove their identify (and possibly their creditworthiness and level of certification).

- These passing the test are issued a creditworthiness and level of in which the applicant „s public key is encrypted by the authority „s private key.

- The protocols previously discussed support secure transaction. As well as more advanced secure transport capabilities.

- The secure transaction protocols discussed here are more narrowly focused.

- For secure payment, internet hardware (software vendors have made a variable of an noun cements in the past couple of years related to the support for the most popular security payment protocols. Three methods have evolved in the recent past.

- Netscape Communications Corporation and Microsoft Corporation have promoted their respective payment protocols and installed them in world wide web browsers and servers.

- SEPP have been championed by master card and Netscape and by other supporters; the American national standards institute (ANSI) is fast – tracking SEPP as a standards for the industry.

- STT (http://www.visa.com/vista-stt/index.html) was developed jointly by visa and Microsoft as methods to secure bankcard transaction over open net network.

- STT user cryptography to secure confidential information transfer, ensure payment integrity, and authenticate both merchants and cardholders confidentiality of information is ensured by the use of digital signature; cardholder account authentication is ensured and merchant credentials and interoperability is ensured by the use of specific protocols and message formats.

- At this juncture ,it appears that SET will become the industry defected standard SET has emerged recently as a convergence of the previous standards and has a lot in common with SEPP.SET is expected to be rapidly incorporated into industrial – strength “merchant ” already available from net cape , Microsoft, IBM, and other software sellers.

Security electronic payment protocol (SEPP):

- IBM , Netscape , GTE , cyber cash , and MasterCard have cooperatively developed SEEP an open , vendor natural no properties license free specification for security online transaction may of its concept were rolled into SET.

- There are several major business requirement addressed by SEPP.

- To enable confidentially of payment information.

- To ensure integrity of all payment data transmitted.

- To provider authentication that a credit holder is the legitimate owner of a card account

SEPP Process:

- To provided authentication that a merchant can accept master card bounded card payments with an acquiring member financial institution

- SEPP assume that the card holder and merchant have been communicating in order to negative terms of purchase and generate an order this process may be conducted via a www browser ; alternative this operation may be performed through the use of electronic mail, via user's review of a paper or CD-ROM catalogue or other mechanism.

- SEPP is designed to support transmit ion activity exchanged in both interactive (Online) and non-interactive (off) models.

- The collection of element involved in electronic commerce

- Cardholder: this is authorized holder of a bank card supported by on issue and register to perform electronic commerce

- Merchant : This is a merchant of goods services and or e-products who accepts payment for them electronically and line may provide selling service and are electronic delivery of items for sale (e.g., E-product)

- Acquirer: This is a (master card member) financial institution that supports merchant by providing service for processing credit card based transaction

- Certificate management system: This is a agent of one or more bankcard association's that provides for the creation and distribution of a electronic certificates for merchants acquires and cardholder.

- Bank net : this represented the existing network which interface acquires issuer and the certificate management system.

- Purchase order request

- Authorization request

- Authorization response

- Purchase order inquiry

- Purchase order inquiry response

- The merchant send an authorization request to the acquirer .the acquirer

performs the following tasks;

ü Authenticates

the merchant

ü Verifies the

acquirer/merchant relationship

ü Decrypts the

payment instruction from the buying cardholder.

ü Validate that

the buying cardholder certificate matches the account number

used in the purchase

ü Validates

consistency between merchant's authorization request and the

cardholder's payment instruction

data

ü Formats a

standard authorization request to the issues and receives the

response

ü Responds to the merchant with validates authorization request response.

SEPP

architecture:

· The SEPP buying

cardholder is represented by a cardholder workstation

which, in the initial

implementation, can be based on a World Wide Web

browser.

· Off-line

operations using e-mail or other non-interactive payment

transaction are also supported by

the protocol.

· To obtain a

certificate the buying cardholder's PC software interface with

the certificate management

system.

· The SEPP

acquirer consists of a traditional acquirer with the addition of an

acquirer gateway and a merchant

registration authority .

· It is also used

in SEPP for cardholder certificate authorization between the

certificate request server and

the issuers. Bank net provider interface based

on ISO formatted message.

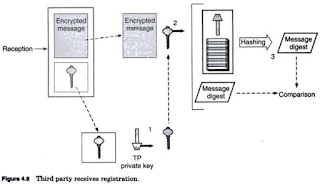

Secure

Electronic Transaction(SET):

· SET is becoming

the de facto standard for security .

· The given

depicts its operation.

· The following

list depicts key function of the specification .

ü Provide for

confidential payment information and enable confidentiality of

order information that is

transmitted with payment information.

ü Ensure integrity

for all transmitted data.

ü Provide

authentication that a buyer is a legitimate user of a branded(e.g.,

Visa, MasterCard, American

Express)bankcard account.

ü Ensure the use

of the best security practice and design techniques to protect

all legitimate parties in an

electronic commerce transaction .

ü Ensure the

creation of a protocol that is neither depend on transaction port

security mechanisms nor prevent

their use.

ü Facilitate and

encourage interoperability across software and network

providers.

- Set offers buyers more security than is available in the commercial market

instead of providing merchants

with access to credit card numbers SET

encodes the numbers so only the

consumer and financial institution have

access to them.

· A similar

process takes place for the merchant at the time of the purchase

each parties SET compliant

software validates both merchant and

cardholder before any information

is exchanged.

· SET is a

combination of an application level protocol and recommended

procedures for handling credit

card transaction over the Internet.

· SET based

system will be a major impetus to the comfort level of web

shopping for both merchant and consumer.

The merchant ware that

incorporates SET will be provide online vendors

with seamless, fraud-resistant

way to handle activities ranging from

displaying goods on-line, to

settling credit card transaction via back office

link to banks.

· SET requires

that an individual possess a digital certificate for each credit

card that he or she plans to use.

· The requirement

may cause some management concerns for those user with

more than one credit card.

· Microsoft unveiled

Merchant Server ,a SET complaint internet commerce

product designed for business to

consumer business to business web sales.

· RSA data

security has introduced a developer kit that compiles with SET

.the kit helps developers build

SET capable application without building

from scratch and in supported by

vendors.

· SET does not use

full text encryption because it would require too much

processing time.

· Master card

allied with GTE to develop n initiative for electronic

certification services also under

the SET standard.

· SET goals is not

expected until 1998 or beyond there are several reason for

this.

ü Time is required

to build consensus among a critical mass of users for

credit card usage, as well as to

build a consensus among a critical mass of

usage for business-to-business

web commerce.

ü It may take

several years for technical specifications and implementations to

be installed, tested, and

debugged.

ü It may take

several years to address how web commerce should be

integrated into internal workflow

processes for businesses, for instance,

handling internal transfer

payments between business units of a company,

handling payments individuals and

businesses.

ü Two to three

years are needed to build confidence among participants that

secure electronic commerce

transactions can, in fact, be made via the

Internet.

Certificates for

authentication:

· A digital

certificate is a foodproof was of identifying both consumers, and

merchants.

· The digital

certificate acts like a network version of a driver‟s license- it is

not credit, bat used in

conjunction with any number of credit mechanisms, it

verifies theusers identity.

· Digital

certificates, which are issued by certificates authorities such as

VeriSign and cyber trust, include

the holder‟s name, the name of the

certificates authority a public

key for cryptographic use and a time limit for

the use of the certificates.

· The certificates

typically includes a class, which indicates to what degree it

has been verified.

· For example,

VeriSign digital certificates come in three classes.

· Nortel also

offers digital certificates as part of its ensues Internet security

software.

· Both Hewlett –

Packard company and IBM have announced their intentions

to use Entrust with their

electronic commerce and security products.

· One of the

issues affecting the industry, however, is interoperability. The

document certification practice

statement issued by VeriSign proposes

interoperability approaches, but the outcome was unknown at press time.

Security on web

servers and enterprise networks:

· There are two

general techniques are available;

v Host security

consideration

v Enterprise

network security

· Host based

security capabilities; these are means by which each and every

Computer on the system in

mode(more) impregnable.

· Security

watchdog system which guard the set of internal interconnected

Systems, communication between

the internal world must be funneled

Through, these system.

· These watchdog

systems that deal with security within an organizations

own enterprise networks are

called firewalls.

· A firewall

allows a business to specify the level of access that will be

afforded to networks users.

In general, both

methods are required.

v An internet site

can set up an anonymous FTP site that allows any outside

user to access files at the site

(anonymous FTP is very useful to companies

that wish to place documentation

in the public domain; it also can be used to

allow users to download

software).

v This could be as

a start alone system which is updated only by off-line

means (eg., load a diskette),or

by a physically separate post (eg, console

port); or, it could be a system

outside the firewall (but still residing on the

overall organization's networks)

called a bastion.

v The firewall

comes into play if the FTP system located on the

organization's networks, for case of updating.

Host security

considerations:

· Host security is

a discipline that goes back to the 1960‟s main frame were

perhaps endowed with more

rigorous security capabilities than their

successors . Naturally ,security

comes at a price including the following

ü The Financial resource

spent in acquiring the constituent element such as

packet filters proxy server log

hosts ,vulnerability detection tools, smart

cards ,and so on.

ü The staff time

spent configuring these tools identifying and correcting

security holes and training the

users about the new tools.

Venues to host

infraction:

· In a stand alone

host environment ,host access can be restricted to logging

in at the console through the

serial port card or over a restricted dialup line

in a network environment a web

server, for example access is typically

available from a variety of

sources.

ü Individual

accessing information on the organization host(Web/HTTP)

ü Individual

accessing the organization host transparently(e.g., NFS,NIS)

ü Individual

interrogating the organization host(e.g., via ping, finger, dig,

nslookup )

ü Individual

running programs on the organization host(rsh , x)

ü Individual

taking and leaving things (mail,UUCP,FTP,rcp)

ü Individual

understanding networks logins(rlogin,Telnet)

· The majority of

communication utilities in host were designed in the 1970

and 1980 without a high regard

for security at a time the goal way easy

network access .

· Anyone with

administrative powers can reconfigure a host‟s IP address and

create specific accounts in order

to masquerade as another host and user on

the network.

Host Based

security tools include the following:

v Monitoring and

logging tools

v Filtering Tools

v Vulnerability

detection tools

Web security

concerns include the following

· Server side

security which involves protecting hosts running the WWW

servers themselves

· Client side

security which relates to security issues involved in requesting

WWW service.

· Confidentiality

which aims at guaranteeing the privacy of information

transmitted across the network between clients and servers.

Some basic

precautions for the server are the follows

· The http demon

server should be executable only by root and is to be

typically invoked only at

execution time.

· All files and

directories in the server directory structure should be owned by

root.

· Do not allow

user to install scripts in this directory

· Remove all

ability for remote logins such as rlogin or telnet

· Remove all

nonessential compiler and programming tools that might be

used by attackers to create or

run programs on the server.

Enterprise

Network Security:

· A firewall (also

called a secure Internet Gateway ) supports communication

based security to screen out

undesired communication which can cause

havoc on the host

· Host based

security is a critical element of overall computer security

although is does not scale easily

,nonetheless it must be employed.

· Ideally an

administrator use all available tools including host security and

communication gateway security .

· It is like

having two lacks on a door both methods should be used for

increased assurance .the firewall

deployment in the enterprise network must

support the following

capabilities ,

ü All traffic

between the inside and outside must transmit through the

firewall.

ü Only authorized

traffic based on the security policy is allowed transit the

firewall itself must be immune to

penetration .

· Firewalls act as

a single focus for the security policy of the organization and

support advanced authentication

techniques such as smart card and one

time password.

· Firewall are

typically configured to filter traffic based on one of two design

policies.

ü Permit unless

specifically denied this is weaker because it is impossible to

be aware of all the numbers

network utilities you may need to protect

against specifically this

approach does not protect against new internet

utilities .

ü Deny unless

specifically permitted this is stranger because the administrator

can start off with a blank permit

list and add only those function that are

explicitly required.

· There are some

variation in firewall architecture which modulated both the

security level as the cost and

complexity of the hardware .

· There are two categories of firewall

IP and or TC/UDP

datagram(packet)filters(including screening

routers)which parse/filter

traffic based on some combination of IP host and

Network address ,IP protocol

,Port number, and possibly other values.

ü Application

layer protocol gateways (also known as proxy servers )which

are intermediately hosts that

accept incoming request for communication

services and make the appropriate calls on the client behalf.

Electronic

Payment and Electronic payment schemes:

· E-Cash is a form

of an electronic payment system where a certain amount of

money is stored on a client‟s

device and made

accessible for online transaction

.

· Stored-value

card – A card with a certain amount of money that can be used

to perform the transaction in the

issuer store .

Internet

Monetary payment and security Requirement:

· For consumer and

merchant to be able to trust one another ,Prevent

transmitted payment information

from being tampered with and complete

transaction with any valid party

,the following issues need to be addressed:

ü Confidentiality

ofpayment information

ü Integrity of

payment information transmitted via public networks

ü Verification

that an accountholder is using a legitimate account

ü Verification

that a merchant can accept that particular account

ü Interoperability

across software and network provider.

Confidentiality

of payment information:

· Payment

information must be secure as it travels across the internet ,without

security payment information

could be picked up by hackers as the router

communication line or host level

possibly resulting in the production of

counterfeit card or fraudulent

transaction.

· There are two

encryption methods used symmetric cryptography and

asymmetric cryptography.

· Symmetric

cryptography or more commonly called secret key cryptography,

use the same key to encrypt and

decrypt a message.

· A commonly used

secret key algorithm is the Data Encryption

Standard(DES)

·

Asymmetric

cryptography ,or public key cryptography ,use two distinct keys :a public key

and a private key.

· This allows

multiple senders to receiver who uses the private key to

decrypted it .The assurance of

security is dependent on the receiver

protecting the private key.

· For merchants to

use secret key cryptography ,they would each have to

administer individuals secret key to all their customer and provide these

keys through some secure channel

.This channel complex from an

administrative perspective.

· This process

,the customer generate a random number used to encrypt

payment information using DES.

The DES encrypted payment information

and the encrypted DES key are

then transmitted to the merchant.

· To decrypt the

payment information the merchant first decrypt the DES key

then use the DES key to decrypt the payment information .

Payment information Integrity :

· Payment

information sent from consumer to merchants includes order

information, personal data and

payment instruction .The information is

modified ,the transaction may no

longer be accurate.

· To eliminate

this possible source of error or fraud, an, arithmetic algorithm

called hashing. The hash

algorithm generates a value that is unique to the

payment information to be

transferred.

· A helpful way to

view a hash algorithm is as a one way public cipher, in

that

Ø It has no secret

key

Ø Given a message

digest there is no way to reproduce the original

information.

Ø It is impossible

to hash other data with the same value.

· To ensure the

integrity the message digest is transmitted with the payment

information .The receiver would

then validate the message digest by

recalculating it once payment

information is received .

· If the message

digest does not calculate the same value sent the payment

information is assumed to be

corrupted and is therefore discarded.

· To rectify the situation the message digest is encrypt using a private key of

the sender (customer).This

encryption of a message digest is called a digital

signature.

A digital signature is created by

using public key cryptography ,it is

possible to identify the sender

of the payment information .The encryption

is done by using the private key

of a public /private key pair this means only

the owner of that private key can

encrypt the message digest.

· Note that the

roles of the public/private key pair in the digital signature

process are the reverse of that

used in ensuring information confidentiality.

· A digital

signature however ,does not authorize a particular customer to use

the monetary account information

located in the payment.

Account holder

and merchant authentication:

· Similar to the

way card accounts are stolen and used today, it is possible for

a person to use a stolen account

and try to initiate an electronic commerce

transaction .

· A way to secure

this link is by use of a trusted third party who could

validate the public key and

account of the customer this third party could be

one of many organization

,depending upon the type of account used.

· For example if a

credit card account were used the third party could be one

of the major credit card

companies ;if a checking account were used ,the

third party could be the federal

clearinghouse or some other financial

institution .

· Merchants would

then decrypt the public key of the customer and ,by

definition of public key

cryptography ,validate the public key and account

of the customer. For the

preceding to transpire ,however, the following is

assumed

Ø The public

key(s) of the third party (i.e.)is widely distributed

Ø The public key(s)

of the third party(i.e.) is highly trusted on face value

Ø The third

party(i.e.) issue public keys and accounts after receiving some

proof of an individual's identity.

Interoperability:

· For electronic

commerce to take place ,customer must be able to

communicate with any merchant.

· Interoperability

is then achieved by using a particular set of publicly

announced algorithm and process

in support of electronic commerce.

4.2 Payment and

purchase order process:

Overview:

· For an

electronic payment to occur over the internet the following

transaction/process must occur.

Ø Account holder

registration

Ø Merchant

registration

Ø Account holder

(customer) ordering

Ø Payment

authorization

Account holder registration :

Account holder must register with

a third party (TP)that corresponds to a

particular account type before

they can transact with any merchant.

· In order to

register ,the account holder must have a copy of the TP‟s public

key of the public/private key

set.

· To register the

account holder will most likely be required to fill out a from

requesting information such as

name, address, account number, and other

personal information when the form is completed the account holder software will do the following.

1.Create and attach the account holder's public key to the form

2.Generate a message digest from

the information

3.Encrypt the information and

message digest using a secret key

4.Transmit all times to the TP

· When the TP receives the account holder's request, it does the following

PAGE-2

PAGE-2

No comments:

Post a Comment